Used Vehicle Search

Welcome to Sportif Motor Group

The premier Citroën, Fiat and Abarth dealer in Aylesbury. Sportif Motor Group is home to a host of experts that can take your experience above and beyond.

Our advanced facilities, years of experience and reputation ensure that our customers will benefit from a first class experience whenever they visit us.

Looking for the perfect blend of reliability, affordability, and style in your next vehicle purchase? Look no further than Sportif Motor Group, your premier destination for quality new and used cars in Aylesbury, Buckinghamshire. With a diverse selection of manufacturers including Citroen, Fiat and Abarth, we offer an extensive range of vehicles to suit every need and preference. Whether you're in the market for a sleek saloon, a practical hatchback or a versatile SUV we have something for everyone. At Sportif Motor Group, we understand that buying a car is a significant investment, which is why our expert team is committed to providing exceptional service and guidance to ensure you drive away with confidence in your purchase.

In addition to our range of new vehicles, we also have a variety of Approved Used models ready to be driven home. With each one passing stringent quality tests, you can be sure of their quality – browse through our stock online and get in touch to find out more about our quality promise.

Our dedicated business centre offer the latest commercial vehicles from Citroën and Fiat Professional. With a wide selection of vans available, from the compact Citroen Berlingo up to the spacious Fiat Ducato, to all electric commercial vehicles, you can be sure to find the perfect solution for your company’s requirements.

For current and future owners alike, our service centre can provide you with the manufacturer approved repairs, maintenance and genuine parts that you need. We can also give your car an MOT at our centre and, as part of our excellent aftercare support, set up a service plan.

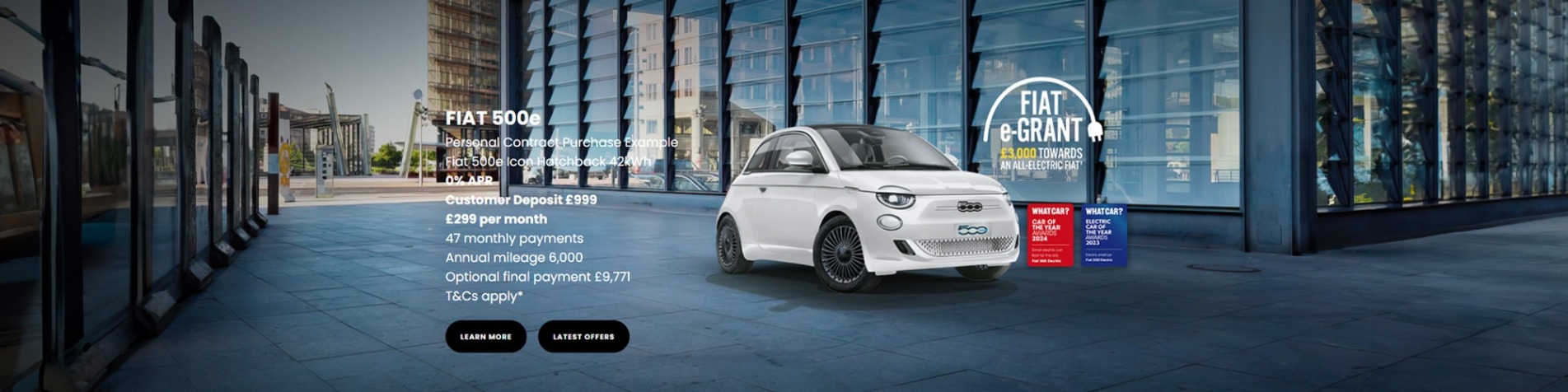

Browse our website to see the full range of vehicles that we have in stock, as well as the attractive finance, Motability and business offers we provide. If you have any enquiries or would like to book a test drive, you can contact us by filling in the provided enquiry form or calling us today.